The NYT recently published an interesting article on the occasion of Google's market cap matching that of Warren Buffet's Berkshire Hathaway.

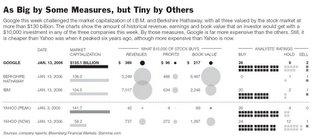

See the attached chart. The analysis looks at the relative claims of $10,000 worth of IBM, Google, Yhoo today, Yhoo peak valuation, and Berkshire Hathaway shares on respective revenues and net profits .

The analysis illustrates that a company's improvement in fundamentals may not be matched by a corresponding improvement in stock price. YHOO is down 66% from its peak while $10,000 of YHOO stock now has claim to 17.5x more revenue, 68x more net profit, and 14.5x more book value than at its peak valuation.

The separation from fundamentals and valuation, realistic forecasts and market cap, etc become particularly problematic when market sentiment changes. The questions of where is the floor and what is the intrinsic value are begged by the separation. With GOOG swinging $15 in a given day, it may pay to think about the analysis and YHOO's recent history.

No comments:

Post a Comment