As the pundits debate next Sunday's Superbowl, my friend Dave Cotter's company, Mpire, developed a Superbowl Index based on eBay's listings of Seahawk and Steeler paraphernalia. On average, Seahawk items sell for ~$50 more.

The Index is a clever means of showcasing Mprie's Researcher product and is probably as accurate as any TV pundit when it comes to forecasting a winner. It looks like whoever wins, eBay will take a cut along the way:)

A personal blog sharing ideas and observations on start-ups, the vc industry, technology, and life.

Sunday, January 29, 2006

Friday, January 20, 2006

1 (800) 411-METRO

Matt Marshall recently wrote an article on the $8bn directory services market and other emerging mobile information models. Matt profiles a recent addition to the HWVP portfolio, Infreeda.

Infreeda provides nation-wide, human operator, ad supported 411 calls. Very simply, dial 1 800 411 METRO the next time you are looking for a listing and stop paying high fees (~$1.75 per call) for information.

Let us know your feedback.

Infreeda provides nation-wide, human operator, ad supported 411 calls. Very simply, dial 1 800 411 METRO the next time you are looking for a listing and stop paying high fees (~$1.75 per call) for information.

Let us know your feedback.

Thursday, January 19, 2006

Instant Gratification

Last night, Hummer Winblad hosted a dinner at Stanford for GSB, CS, and EE students. Stanford students are remarkably entrepreneurial and the energy around new company formation is impressive.

Over dinner, several questions were raised with respect to design considerations for new enterprise software companies. In thinking through an answer, the following thoughts came to mind.

What is the time to value quotient? How long does it take for the customer to realize value from your product? Compare and contrast clicking on a URL to self-provision versus a two-month on-premise proof of concept.

What is the customization to value quotient? How much customization is required before the customer sees relevance and value?

How much manual labor is required to realize value? How many sales engineering and professional services hours are required to both explain the merits of the solution and have it running successfully in the customer's environment? The common element of MySQL or Salesforce.com appears to be that customers self-validate through low-risk experimentation without the need for vendor sales engineers.

What is the risk of experimentation? Does the customer need to pay for a proof of concept? Does the customer need to requisition IT resource (new servers, open up a firewall port, etc) to enable your product to showcase its benefit? As with the MySQL comment above, can the customer experiment and test the value proposition without material risk or expense?

What is the time to integration? Can the product provide standalone value that obviates the need for day one systems integration, a la SFA? To the extent integration is required, how standardized are the interfaces to relevant up and downstream systems that add value to the solution?

The consumer internet offers useful lessons and direction for the enterprise space. Customers self-provision, self-validate, self-integrate, and self-configure.

The dinner offered some great ideas and insights, and I look forward to seeing the great new companies that are currently being hatched on campus.

Over dinner, several questions were raised with respect to design considerations for new enterprise software companies. In thinking through an answer, the following thoughts came to mind.

What is the time to value quotient? How long does it take for the customer to realize value from your product? Compare and contrast clicking on a URL to self-provision versus a two-month on-premise proof of concept.

What is the customization to value quotient? How much customization is required before the customer sees relevance and value?

How much manual labor is required to realize value? How many sales engineering and professional services hours are required to both explain the merits of the solution and have it running successfully in the customer's environment? The common element of MySQL or Salesforce.com appears to be that customers self-validate through low-risk experimentation without the need for vendor sales engineers.

What is the risk of experimentation? Does the customer need to pay for a proof of concept? Does the customer need to requisition IT resource (new servers, open up a firewall port, etc) to enable your product to showcase its benefit? As with the MySQL comment above, can the customer experiment and test the value proposition without material risk or expense?

What is the time to integration? Can the product provide standalone value that obviates the need for day one systems integration, a la SFA? To the extent integration is required, how standardized are the interfaces to relevant up and downstream systems that add value to the solution?

The consumer internet offers useful lessons and direction for the enterprise space. Customers self-provision, self-validate, self-integrate, and self-configure.

The dinner offered some great ideas and insights, and I look forward to seeing the great new companies that are currently being hatched on campus.

Wednesday, January 18, 2006

Share of Revenue and Profits

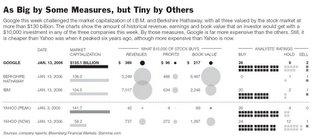

The NYT recently published an interesting article on the occasion of Google's market cap matching that of Warren Buffet's Berkshire Hathaway.

See the attached chart. The analysis looks at the relative claims of $10,000 worth of IBM, Google, Yhoo today, Yhoo peak valuation, and Berkshire Hathaway shares on respective revenues and net profits .

The analysis illustrates that a company's improvement in fundamentals may not be matched by a corresponding improvement in stock price. YHOO is down 66% from its peak while $10,000 of YHOO stock now has claim to 17.5x more revenue, 68x more net profit, and 14.5x more book value than at its peak valuation.

The separation from fundamentals and valuation, realistic forecasts and market cap, etc become particularly problematic when market sentiment changes. The questions of where is the floor and what is the intrinsic value are begged by the separation. With GOOG swinging $15 in a given day, it may pay to think about the analysis and YHOO's recent history.

Thursday, January 12, 2006

RSS Ad Stats

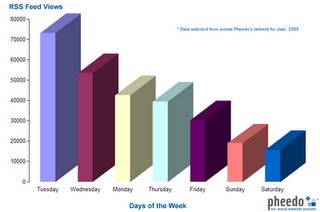

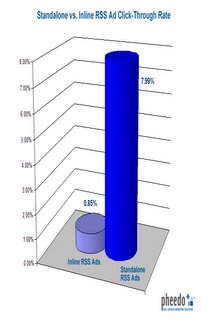

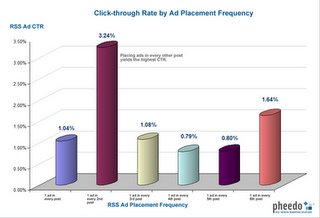

With RSS traffic and RSS reader adoption booming, ad impressions on traditional sites will inevitably go down. Web publishers will need to work out how to make money off of the RSS r/evolution via embedding ads in RSS.

For some very useful statistics on RSS advertising click-through-rates and RSS reader behavior, check out Pheedo's blog - Pheed Read #1 and # 2.

The feeds are instructive and suggest that RSS ads significantly outperform traditional web advertising wrt CTRs. Furthermore, given RSS subscriptions allow for more effective targeting and segmentation it is likely that the CPCs will be higher than with traditional on-line ads. Web publishers may find that driving RSS usage increases ad-related revenues despite a decline in "home site" web-site page views.

I would love to talk with people working actively in this area. Thanks to Pheedo for the data.

Wednesday, January 11, 2006

Living History - Sun Founders Panel

Tonight, the Computer History Museum in Mountain View hosted a fabulous event with the four founders of Sun - Vinod Kholsa, Scott McNealy, Andy Bechtolsheim, and Bill Joy. If you enjoy history and technology, I encourage you to come to future events and to support the only museum in the world dedicated to the collection and preservation of the software, documentation, hardware, images, and personal histories that represent the innovation and advances in IT.

The wonderful reality about the technology industry is that a significant number of IT industry pioneers and innovators are not only still with us (Jobs, Joy, Bechtolsheim, etc), but also remain vibrant participants in the economy they helped to create. Tonight really was living history with the people on stage recounting the founding of Sun in 1982 and the adoption of open systems, Unix, RISC, Java, network based computing, the constant ying and yang of fat vs thin clients, and the MSFT vs Sun world views.

Sun's sales in the first six years - $8.5m to $1bn- testify to its force as disrupter, and yet I have to tip my hat to the company and founder's staying power. Here we are 24 years later and 50% of the founders remain employees and Sun remains a force in the market place.

WRT disruption, it is instructive to note that open systems were lightly regarded by the investment community in 1982, which is very similar to Marc Benioff's experience raising money for SaaS-based CRM in the late 1990s. The common elements in both examples appear to be a price/performance ratio improvement and an alignment to the customers' interests that the competition's business model did not allow for. Yet the investment community, in both instances, reflected the incumbent's world view. It seems to be a truism that large companies in technology can innovate (Xerox Parc being the poster child) but that they remain vulnerable with respect to brittle cost structures, business models, and organizational dynamics that make it difficult to use the very technologies their research labs are innovating. Perhaps the best answer to "why can't a large company do what you do Mr Start-up," is to say they probably can but they can't afford to - history, that is living history, says that's true.

The wonderful reality about the technology industry is that a significant number of IT industry pioneers and innovators are not only still with us (Jobs, Joy, Bechtolsheim, etc), but also remain vibrant participants in the economy they helped to create. Tonight really was living history with the people on stage recounting the founding of Sun in 1982 and the adoption of open systems, Unix, RISC, Java, network based computing, the constant ying and yang of fat vs thin clients, and the MSFT vs Sun world views.

Sun's sales in the first six years - $8.5m to $1bn- testify to its force as disrupter, and yet I have to tip my hat to the company and founder's staying power. Here we are 24 years later and 50% of the founders remain employees and Sun remains a force in the market place.

WRT disruption, it is instructive to note that open systems were lightly regarded by the investment community in 1982, which is very similar to Marc Benioff's experience raising money for SaaS-based CRM in the late 1990s. The common elements in both examples appear to be a price/performance ratio improvement and an alignment to the customers' interests that the competition's business model did not allow for. Yet the investment community, in both instances, reflected the incumbent's world view. It seems to be a truism that large companies in technology can innovate (Xerox Parc being the poster child) but that they remain vulnerable with respect to brittle cost structures, business models, and organizational dynamics that make it difficult to use the very technologies their research labs are innovating. Perhaps the best answer to "why can't a large company do what you do Mr Start-up," is to say they probably can but they can't afford to - history, that is living history, says that's true.

Wednesday, January 04, 2006

Personal Equity

Steve Bird of Focus Ventures wrote an interesting paper on what drives venture capital returns.

The paper looks at two investment cycles: the PC era of 1983-1987 and the Internet boom of 1997-2001. In the former era, the top 50 firms represented 13% of the industry and captured 44% of the value created. In the latter era, the top 50 firms represented 4% of the industry and captured 66% of the value created.

The moral of the tale to LPs is that if you cannot get your money in a top firm then don't invest in the asset class.

Click above to get the PDF.

The paper looks at two investment cycles: the PC era of 1983-1987 and the Internet boom of 1997-2001. In the former era, the top 50 firms represented 13% of the industry and captured 44% of the value created. In the latter era, the top 50 firms represented 4% of the industry and captured 66% of the value created.

The moral of the tale to LPs is that if you cannot get your money in a top firm then don't invest in the asset class.

Click above to get the PDF.

Subscribe to:

Posts (Atom)