A personal blog sharing ideas and observations on start-ups, the vc industry, technology, and life.

Tuesday, December 30, 2008

book recommendation: The Shadow of the Wind

Over the holidays, a friend casually suggested that I read a book by the Spanish author Zafon. 7 hours later, I had finished what is the most wonderful book I have read this decade.

Carlos Ruiz Zafon's, The Shadow of the Wind, is simply amazing. The book, written in 2001, takes place in post-war Barcelona - the narrator, Daniel Sempere, is the teenage son of a bookseller. After finding a book by the little-known auther, Carax, the boy discovers that, despite the brilliance of Carax's work, all his books are being destroyed one by one.

As Daniel seeks to uncover why, he stumbles into a spider's web of forgotten murders, doomed love, and secret pasts.

The book is a gift and one to savor. Let me know if you enjoyed it and if you can suggest one that proved equally moving to you.

Thursday, December 04, 2008

Change.gov Widget

Monday, December 01, 2008

Amish Jani - New Blogger

Wednesday, November 19, 2008

The End of Wall St's Boom

Wednesday, November 12, 2008

Tenacity

A list of Abraham Lincoln failures (along with a few successes) follows:

- 1831 - Lost his job

- 1832 - Defeated in run for Illinois State Legislature

- 1833 - Failed in business

- 1834 - Elected to Illinois State Legislature (success)

- 1835 - Sweetheart died

- 1836 - Had nervous breakdown

- 1838 - Defeated in run for Illinois House Speaker

- 1843 - Defeated in run for nomination for U.S. Congress

- 1846 - Elected to Congress (success)

- 1848 - Lost re-nomination

- 1849 - Rejected for land officer position

- 1854 - Defeated in run for U.S. Senate

- 1856 - Defeated in run for nomination for Vice President

- 1858 - Again defeated in run for U.S. Senate

- 1860 - Elected President (success)

Friday, October 24, 2008

Book Recommendation: The Snowball

Roger Lowenstein wrote a wonderful biography of Buffet, The Making of An American Capitalist.

Now, Alice Schroeder, a former insurance analyst, brings us The Snowball: Warren Buffet and the Business of Life.

Warren Buffet allowed Schroeder unparalleled access to his records, business partners, and family and delivers a masterful portrayal of a master businessman. In return, we are granted valuable and entertaining insights into Buffet's life, philosophies, and world view.

Wednesday, October 22, 2008

Travel Schedule

Digital Hollywood's Widgets as a Platform on Oct 28th

Widget Summit's Meet the Galleries, on Nov 3rd

Pubcon's The Wonderful World of Widgets on Nov 13th

If you plan to be at any of the events above, please let me know. will @ widgetbox.com

Monday, October 20, 2008

Another Chapter in the Life is Stranger Than Fiction Column

PALM BEACH GARDENS, Fla. (AP) — U.S. Rep. Tim Mahoney, embroiled in an adultery scandal and a tight race for re-election, admitted Friday to having at least two affairs but insisted he broke no laws and will not resign. The first-term Democrat conceded that one of the affairs began as he was running on a family values platform to replace Mark Foley, a Republican who resigned amid revelations that he sent lurid Internet messages to male pages who had worked on Capitol Hill as teenagers. Mahoney, 52, apologized to his wife, his daughter and his constituents, even as he maintained he hadn't been hypocritical.

Saturday, September 20, 2008

Announcing the Widgetbox Blog Network

The Widgetbox Blog Network connects bloggers across 29 channels (from art to celebrities to music to politics) using a single widget that dynamically showcases content across all of the blogs in that channel. You’ll notice, for instance, that I’ve joined the Tech News Channel and placed the widget in the top right of my blog template. On each page view, new blog posts are dynamically presented from other bloggers also in the Tech News Channel - and likewise, my blog posts appear on their pages… effectively driving highly relevant traffic across the network and taking advantage of Widgetbox’s large audience / community.

Why are we launching a blog network? Simple, at Widgetbox, bloggers and blogs are the core of our community and the new Blog Network:

- Widgetbox has widgets on over 250,000 unique blogs

- Blidgets (blogs we help turn into widgets) have been served over 1.5 BILLION (!) times

- Widgetbox now reaches over 65 million unique each month (verified by Quantcast)

You will also notice that the widget is customized for my blog – showing a badge of my blog and its rank within the Channel (I’m #8 - need to blog more).

Joining is easy:

1. Visit http://www.widgetbox.com/network and select the Channel that fits your blog

2. Click the Join This Network button, select your blidget (or create one) and then grab the Channel Widget’s code

3. Add the code to your blog template and press activate

I attach a copy of the PowerPoint briefing here:

Thursday, September 18, 2008

Websites Losing Relevancy for Brand Strategy and Consumer Engagement

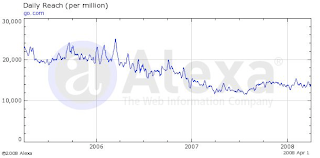

The charts below are from Peter’s post and they illustrate the massive fall off in reach experienced by members of the Fortune 500. The CNN daily reach per million data below is particularly telling, a significant relative decline over a two-year period.

The measure of web marketing success used to be measured in page views, visits, and reach. Millions were spent on powerful sites and on related marketing campaigns that focused on driving users back to the company web site. In today’s age, however, of RSS readers, social networks, and huge numbers of user-generated sites, the paradigm has changed. The goal can no longer be simply to funnel traffic back to cnn.com, but rather the new goal is how best to take the content, applications, and ad inventory from cnn.com to the users.

Widgets, social media applications, and RSS feeds are the modern day web marketers tools and the model has inverted from driving users to content to driving content to users.

Peter is also the founder and CEO of iWidgets, a newly launched widget and social application builder that allows brands to take their content and services onto the distributed web and off-domain. The service is currently in beta and well worth checking out. He launched with CBS and is helping to make social syndication of tier one content a reality.

Wednesday, September 17, 2008

Quick Feedback: On-line Ad Growth Rates

He sees the following growth rates for the on-line ad market

Q3: low teens

Q4: mid single digits

2009: flat

Mix: display down with search growing at display's expense.

Key point: does not see the 20% growth forecast earlier this year by many market watchers.

How will experimental budgets hold-up?

The need to prove efficiency, engagement, and performance will be critical, as will the ability to prove differentiated reach.

Where is Money Going?

The Dow fell today 450 points or 4.6%, the S&P 500 fell 57 points or 4.7%, and the NASDAQ fell 109 points or 5%.

Morgan Stanley fell 24% and Goldman, the bluest chip financial firm in the world, fell 14%. GOOG feel $28+, or 6.42%, Yahoo! fell

Where is the world putting its money - gold, up close to $80 dollars today.

As 2009 budgets firm up, we will see if the performance benefits of on-line advertising protect the sector from a downturn. The current growth rates project 20% y-o-y upticks in on-line spend. For start-ups, the overall growth rate certainly matters, but more importantly advertiser appetite for experimenting with new mediums and technologies matters more. The on-line market's growth can slow but IF advertisers' appetites for trialing new ad channels remains robust newer markets will grow faster than the overall market.

Two data points to watch closely - total on-line ad market spend and mix/reallocation within the total spend. For start-ups to grow, the overall allocation and the allocation to experiment with new technologies and forms of advertising will matter a great deal.

Book Recommendation: Supreme Courtship

The mendacity, absurdity, and sick humor of the current political age is brilliantly captured and skewered in Christopher Buckley's new book, Supreme Courtship.

Buckley tells the tale of President Vanderdamp and his efforts to nominate a new Supreme Court justice. Unfortunately for the President, the Chairman of the Judiciary Committee wants the job. The greedy senator blocks two incredible candidates, one for writing, at the age of 12, a critical film review of To Kill a Mockingbird for the school paper. Clearly, a racist.

Ticked off at the Senate for rejecting his nominees, the President decides to get even by nominating America's most popular TV judge to the Supreme Court. Judge Pepper - a hot version of Judge Judy - prepares for the nomination process and the insanity begins.

Great read and a book that perfectly captures the disfunction of Washington.

Monday, September 15, 2008

Wall St's Demise and the Impact on Tech

Tuesday, August 26, 2008

Scott Zenko: 1972-2008, RIP

For me, a brother, friend, uncle, and inspiration. A free spirit constant in his love for life, family, friends, and the next adventure.

Thursday, August 21, 2008

Widgetbox Posts

I recently posted two blog posts on the Widgetbox blog and wanted to share them here.

Wednesday, August 06, 2008

Widgetbox at SF New Tech

Thanks to Lawrence at RateitAll for organizing the event.

Saturday, July 26, 2008

Alacatraz 100 - One to Add to the Bucket List

The weather, tides, wind, and fog all cooperated and made for an amazing day and experience.

I understand the movie the Bucket List proved to be so-so, the idea, however, of making a list of things to do before you die is cool.

After today, I would suggest, if you enjoy outdoor challenges, that you add the Alcatraz 100 to your list.

As I checked in for the race, the organizer asked me to promise him one thing....in the middle of the race stop swimming and take in the setting...Alcatraz behind you, the Bay Bridge to your left, the Golden Gate to your right, and the city of San Francisco looming directly in front of you.

I managed to stop twice and the views will stay withe me...until next year's race!

Thanks to my colleague, Ryan Spoon, for motivating me.

Friday, July 25, 2008

Tuesday, July 22, 2008

Monday, July 21, 2008

SWAT Summit

First, thanks to Cassie Phillipps and the rest of the gang at Room Full of People for putting on a great show and for including us in the conversation.

While the conference centered on how brands and agencies can best harness the power of the social web, the panel focused on specific campaigns and their results. The audience, like many people I speak with, wanted to understand what advertisers can do to leverage social networks and widgets to connect with their audience.

The other panelists were imeem, Votigo, and BeAffinitive.

Widgetbox presented a case study on a cost-per-install campaign that we ran with a music video provider. The results, as you can see by watching the embedded slide show, were powerful. With an 11-day campaign, the widget enjoyed a 50,000% increase in hits, a 110,000% increase in uniques, and a 8,800% increase in subscriptions. The best news is AFTER the campaign finished, hits continue to grow and the widget is enjoying steady organic adoption and distribution.

If you are interested in running a campaign with Widgetbox, please let me know...will.price at widgetbox.com

Mongol, A Movie To See

Jack Weatherford outlines Khan's amazing life story and rise from outcast/orphaned Mongol nomad to ruler of the world's largest ever empire. The book serves as a major rehabilitation of Khan's legacy and transforms the traditional view of Genghis Khan from brutal tyrant to transformative ruler who spread the rise of free trade, religious freedom, science, standards, paper currency, postal services and communications, and national identities in lieu of tribalism, religious persecution, and autarky.

Khan's genius lies in his ability to transcend his circumstances and envision completely novel means of organizing armies, ruling empires, and structuring society (merit vs hereditary and tribal). An Indian friend of mine and admirer of Khan's describes him as being "self-born," a force in history with no precedent and a man of ideas and achievement completely non-linear to his context and roots. I really love that concept.

Now, Sergei Bodrov brings us his brilliant epic, Mongol. The move brings to life the steppes, the man, and the incredible rise from obscurity that marked Khan's early life. It is a movie to get lost in and one that you wish would keep going. The good news....Mongol is the first of three and I cannot wait for the sequel.

Thursday, July 10, 2008

Rich Price - Turn Off My Heart Video

Embedded in this post is the video to the song.

Facebook Turning Off Spammy Apps

The Facebook f8 platform is just over one year-old, and yet to some app makers it must feel like it is hitting the "terrible two's" a little early...

Last week, Facebook suspended Slide's Top Friends app - one of the most popular on Facebook - for privacy violations. It then suspended SocialMe, also for privacy violations, and this morning TechCrunch wrote about the shutting off of all viral elements of RockYou's Super Wall (newsfeeds, notifications, invites, etc.). Today, TechCrunch reports that SpeedDate is now no longer working.

From the app maker's side, this has had immediate and detrimental effects, as user numbers have taken a nose dive from where they have been for many many months. This could have long reaching and deleterious effects for companies such as Slide and RockYou that have focused an enormous amount of their development energies on a select few platforms. Take a look at this graph on Super Wall to see exactly how fast apps have been spread by spammy invites and notifications, and how fast the drop off happens without them:

But, there's another way to look at this. I applaud what Facebook is doing here - they are putting their users first, which is exactly what should matter most to them. Even if these apps have driven a lot of growth for Facebook over the last year, I think I can speak for most Facebook users in saying that a lot of the methods these apps use to spread themselves around can be really frustrating. Time.com had a great article in April that outlines some of the struggles Facebook users have when using apps.

Time.com notes that "the increase in "junk" notifications is enough to leave [Facebook users] feeling peeved," to which Facebook responded months ago by allowing their users to shut off app notifications one by one. But what I believe has been more frustrating for users is that they simply don't always know what they are getting themselves into. This same article outlines this experience perfectly,

An even bigger nuisance with using Facebook apps is that it's not always clear how they work. Tina House of Combine, Tex., says she accidentally posted a Valentine's Day greeting that said "I love you," not just to her husband, but to all of her friends, while using the application Super Wall, because she did not realize that the program defaulted to sending the posting to everyone. "I still shudder over that one," she says. And because advertisements are slickly intertwined with the apps — they often use the exact same font and graphics — it's easy to inadvertently click one by mistake.

I know that I was duped by the "Click to forward to see what happens" on Super Wall, and I spend enough time with widgets and apps that I should have known what was happening.

This latest suspension by Facebook illuminates a continual ratcheting down on spammy aspects of apps over the last few months, and I don't expect it to stop until they feel their user experience is protected. A lot of companies like Slide and RockYou took huge risks in focusing on such a small number of domains (I'm counting Facebook as one domain). They really pushed the envelope - albeit in a number of innovative and effective ways - on optimizing viral spread of their apps, and because of their sharp thinking they (and by proxy, Facebook) saw enormous success from very early on. That same growth is now starting to have diminishing returns for Facebook, as there has been a leveling off of site usage in both the US and the UK, slowdowns which first started rearing their heads a few months ago. Once those diminishing returns kicked in, Facebook had to take action in order to stay ahead.

What is clear to me is that the early success many folks saw on comes with a big price tag, and they may now have to pay the very real and painful costs as Facebook, and I'm sure other app platforms soon, come collecting. Assuming that growth between apps and Facebook will always go hand in hand and be mutually beneficial is a dangerous game to play.

This news also highlights what I think of as the bigger picture here, which is users' desire for choice. At Widgetbox, we often use an analogy to the early days of television. When TV first went mainstream, everyone was thrilled with the three channels that were available. Those channels saw such success that the networks themselves believed they could accurately predict what EVERYONE wanted to watch. Today, we can look at the rise of cable and the hundreds and hundreds of channels out there and see how untrue that was. Really what consumers wanted was choice. They wanted more channels with more programming focused on smaller and smaller niches so they could easily find what they were looking for. They didn't want to have to sit through programs and commercials the networks chose, but rather wanted their television delivered on demand. Maybe no individual channel had as much blockbuster success as the first three, but in the aggregate they changed the face of television dramatically. I believe this analogy is true for widgets/apps as well. We're huge believers in choice and access, and clearly users - and the platforms themselves - are starting to throw up their hands with the more one-size fits all approach that has dominated the landscape thus far.

Essentially, what this news screams to me is the need for independence. Domain independence, app independence, and network independence. Pretty fascinating stuff, and it continues to be a wild and dizzying ride, with no stopping anywhere in sight.

Widgetbox is Hiring

Widgetbox is a Sequoia-funded, 23 person Internet startup based in San Francisco that is improving the Internet through choice and access. By connecting widget consumers, creators and advertisers, we provide choice to those who want it and reach to those who need it. We pioneered the rise of widgets to become home to the world’s first and largest widget community, with more than 70,000 widgets and 45 million monthly viewers on over 920,000 domains.

We are interested in talking with candidates who meet the following requirements.

SKILLS AND REQUIREMENTS

Expert in Java, Servlets, and XML

Proficient with Hibernate and Spring

Development and design experience with Service Oriented Architectures

Experience with MySQL a plus

Team leadership experience

Solid track record of meeting deliverable targets, and taking part in successful releases

Strong understanding of web technologies used in social networking and Web2 sites

Experience with performance and scalability work and designing scalable systems

Custom Galleries from Widgetbox

Wednesday, June 11, 2008

Team Chemistry, Stress, and Success

- team chemistry

- rapid iterations

- clear end-user focus

- deflate - withdraw, become resentfully compliant, are negative

- inflate- yell, raise our voice, lash out, seek to dominate

Sunday, June 08, 2008

Shantaram

Wednesday, May 14, 2008

ThinkTomorrow

Friday, May 02, 2008

List of Service Providers for Start-ups

Tuesday, April 29, 2008

Lost My Voice

Why is it harder to write?

Busier? Not really.

If not that, then what?

It finally hit me today. As a VC, I actively worked with nine to ten investments, met with scores of potential investments, and enjoyed a wonderful perch with which to observe start-up life, the venture process, and best/worst practices.

I could write, "I attended a board meeting today and observed x, y, and z." Or, "today I met a VP Sales who really understand the sales life cycle..." The anonymity of the comments provided cover that allowed for rich detail and candid observations on the week's learnings. The inability to tie a comment to a particular person, venture investor, company...etc makes for rich commentary and illustrative examples.

As a CEO, this is harder - it is not "a" board meeting but "my" board meeting - ie the parables and lessons leave little room to the imagination with respect to the source and people involved.

Furthermore, I am wary to turn my blog into a Widgetbox promotional vehicle and simply post about all the wonderful things we are up to at 1000 Sansome St.

I am working on a voice that can replace the lens into the VC world without Wbox chest-beating and/or Wbox confessionals.

In upcoming posts, I plan to comment on the VC vs operating role choice and my observations on what it is like to move from one side of the table to the other. I know it is the quintessential young VC question - and I hope to share my experiences with those thinking through the two choices.

Apologies for the radio silence - I am working to adapt my blogging voice to my new role.

Tuesday, April 01, 2008

How Widgets and Widgetbox Drive Incremental Traffic

The article below is excellent validation of the power of widgets to drive incremental adoption and of Widgetbox, in particular, to outperform Facebook and Bebo for long-tail widgets. After 7 days, Widgetbox drove 1.7x Facebook's subscriptions and 3.9x Bebo's.

Davids SEO Adventure posted a great article about trying to drive web traffic via widgets and gadgets. David has launched a new website (SodukoWorld.be) and is documenting its growth - and we were pleased to find that Widgetbox has quite helpful thus far:

And after a couple of hours of messing around with Facebook application development, I went of to visit my good ol’ friend Google to see if there was an easier way to do this. And guess what? obviously there was. It came in the name of WidgetBox, the all purpose widget making type system. So I signed myself up, threw some html at it and watched in enwonderment at the resulting usefulness: a SudokuWorld Widget that could be put in Facebook, Bebo, Wordpress and all other sorts of things.

And while creating a widget and Facebook / Bebo application was easy, David also reports that it was effective:

After 2 days

Facebook: 27 users

bebo: 35 users

WidgetBox: 92 usersOutcome: bright and breezy - not too shabby for a beginner

After 7 days

Facebook: 91 users

bebo: 40 users

WidgetBox: 156 usersOutput: wahoo!

We are obviously very excited about those results and helping David's business (and others!) grow.

Wednesday, March 26, 2008

blogger badge - get one today

The blogger badge allows you to provide one click access from a widget to your profiles on:

- facebook

- linkedin

- myspace

- digg

- stumbleupon

- flickr

- your blog

- etc

Thursday, March 13, 2008

Moving from Humwin to Widgetbox

HWVP seeded Widgetbox in April of 2006, and I have steadily grown in confidence in the market, team, and opportunity. The company is an anchor tenant in the web widget marketplace and it will be fun to stay in touch with you all as I move onto a new and exciting chapter in life.

While my six years in venture provided amazing exposure to great teams, companies, and learning, I felt compelled to try my hand, once again, on the operating side. The confluence of my personal aspirations and the quality of the Widgetbox board, investors, team, and market made this an opportunity I could not afford to pass up.

If you have the interest and time, I covered my reasons for the move via a guest post on Techcrunch today.

For those of you who read my blog for insights into the venture business, thank you for reading and commenting on my thoughts to date. From today, the blog will focus on my transition to an operating role, the consumer Internet space, the world of web widgets, and my mistakes and learnings as I look to work with my colleagues at Widgetbox in building a great company.

It should be fun!

Wednesday, March 05, 2008

Why Blog....and Widgets

Brad and I are interviewed - he found Feedburner through his blog and I am very pleased to have found YieldBuild. If you are wondering why we blog, not only is it fun, an incredible forum for learning, but it is also a wonderful vehicle for meeting new people.

Also, I did a podcast (my first one ever) on widgets for Businessweek.com. They recently ran a series of articles on widgets and my talk is part of their CEO Guide to Technology.

Tuesday, March 04, 2008

Magic Number for SaaS Companies

Josh James, CEO of Omniture (a Hummer Winblad

1) Product: build a rock solid product. Prove you can sell it as founders before moving past this step.

2) Sell: Sell like crazy, build out a team, hire some QBSRs (Quota Bearing Sales Reps)

3) Retention: focus on churn and retention issues, hire more QBSRs

4) Marketing: spend on marketing, hire more QBSRs

The next phases, not surprisingly, also included hiring more QBSRs but interestingly it is not until later that investments in efficient infrastructure and operations hit their ToDo lists. This outline displays a strong focus on finding a product market fit and then adding gas to the fire as the market opened up. The key metric that Omniture used to decide how much gas to pour on the fire was the Magic Number.

The Magic Number

The magic number ("MN") is a metric that can be used to tell you the health of your company from the perspective of growing monthly recurring revenue ("MRR"). It is a common mode metric to compare companies MRR scaled by sales and marketing spend. The MN provides insight into the effectiveness of previous quarter Sales and Marketing spend on MRR growth. Your MN will be penalized if the spend is wasted (bad marketing, bad sales execution), if your churn is high or if the market has issues (saturation, competitive forces). It also has a very high correlation with Q/Q growth rates so in general, high Magic Numbers are good.

To calculate:

QRev[X] = Quarterly Recurring Revenue for period X

QRev[X-1] = Quarterly Recurring Revenue for the period preceding X

ExpSM[X-1] = Total Sales and Marketing Expense for the period preceding X

Magic Number = (QRev[X] – Qrev[X-1])*4/ExpSM[X-1]

For example, consider a hypothetical company with the following financials

Q1 Q2 Q3

Revenue (recurring total) 1M 1.2M 1.5M

S&M Expense 800K 900K

Then the magic number is 1.0 for the end of Q2 and 1.33 for Q3.

Fundamentally, the key insight is that if you are below 0.75 then step back and look at your business, if you are above 0.75 then start pouring on the gas for growth because your business is primed to leverage spend into growth. If you are anywhere above 1.5 call me immediately.

Josh provided the following gas-pouring throttle chart for SaaS companies to evaluate how much to invest in their go-to-market spend. The data on the charts if from Omniture and other public SaaS companies.

Calculate yours…and get back to me if it is interesting! For fun and extra credit take a look at difference in Magic Number for some of the public SaaS companies like Omniture and SuccessFactors. I can be reached at lars@humwin.com

Calculate yours…and get back to me if it is interesting! For fun and extra credit take a look at difference in Magic Number for some of the public SaaS companies like Omniture and SuccessFactors. I can be reached at lars@humwin.comTuesday, February 26, 2008

Eat Your Own Dogfood

Last week Phil Wainewright wrote a great post (as he always does) called SaaS vendors, eat your own dogfood, or die. In the post, he describes how SaaS companies need to embrace the SaaS services available in the ecosystem.

I support the viewpoint from the post that SaaS companies need to have religion and leverage SaaS in everyway they can – further, I believe if they don’t they leave themselves open for other SaaS companies to disrupt them. From discussions with the infrastructure management of many leading SaaS companies I often hear how they are forced to use some on-premise pieces on the back-end reluctantly. This has provided the motivation for a few of our SaaS infrastructure investments (eg. Aria – SaaS billing and customer management).

Phil’s title had me thinking along another important vein for SaaS companies…literally to eat THEIR own dogfood and use their own product. For example, Salesforce aggressively uses Salesforce to manage prospects, Omniture eats their own analytics for online marketing, Teleo uses their own product for recruiting and SuccessFactors brags about their own talent management. Luckily we don’t all work for tobacco companies…

My belief is that SaaS companies must use their product for a few reasons:

1) Point of View: it puts everyone in the company in the seat of the customer. This means that the internal teams will live the same pain, the same experience and the same leverage that you are espousing as a vendor. This POV extends the advantages SaaS has of bringing the vendor closer to the customer by putting the customer in the office next door.

2) Analytics: By using your own product you will think about the product extensions and depth of how to apply the benefits of analytics to build stronger products and best practices. SaaS companies have a huge edge with analytics so it makes sense to use them internally as well.

3) Sales Roadblock: a fair question for a prospect to ask would be, “if your solution is so great, why aren’t you using it?" SaaS vendors can do their sales team a great favor by getting ahead of this question.

Any interesting SaaS companies that are using their own product and want to reach out – I’d love to hear from you. Please email me at Lars@humwin.com.

Wednesday, February 13, 2008

Embracing Uncertainty

The Stanford Institute of Design is an inter-disciplinary school that brings together business school students, engineers, and social scientists into an integrative, iterative, and immersive process of discovery.

The process is integrative in that multiple voices of feasibility (engineering), viability (business), and usability (social science) are baked into the process. The process is iterative in that the teams use rapid prototyping and user testing to discover product/need fit. The process is immersive in that the team is placed in the environment of the targeted user to observe and listen.

The core idea is that innovation must be cross-functional, A/B test driven, and that products are shaped gradually over time through a process of feedback rather than declaratively and upfront. The philosophy holds that rather than fight amongst the team about what to do, solve the argument via data-driven tests that are designed to answer key unknowns.

This implies that the only "right" part of a plan that it is "wrong." Moreover, rather than be paralyzed by that fact, the best teams harness the voices of all key departments in the company, let the user guide them, and invest themselves in a process of data-driven, prototype-driven discovery that slowly peels away the "right" answer.

The competitive position of the company is anchored more on whether it is a learning organization - flexible, nimble, user-driven - rather than whether its founders enjoyed a single epiphany of genius.

With respect to venture capital, the implications are interesting. Most teams pitch three-year plans and product roadmaps. Like the book the Black Swan holds, the odds of the forecasts being right are nil - fundamentally, given the forecast error inherent in any plan, the investment decision should not lean heavily on the proposed plan.

Rather, as George and his colleagues would argue, perhaps the investment should be predicated on a defined user/customer target, a process and fluency with A/B testing and prototyping, an integrated team, and an openness to discovery rather than a priori certainty.

Thursday, February 07, 2008

VKernel and Hummer Winblad Join forces on Virtualization Infrastructure

Hummer Winblad is pleased to welcome Alex Bakman and his VKernel team to the Hummer Winblad family. We are very excited for the opportunities ahead and look forward to working together. The recent press release and further details can be found here.

Enterprise IT environments are undergoing one of the biggest shifts in 25 years – shifts that have not been seen since the move from mainframes to client-server. Big shifts in infrastructure open up large gaps in the current management solutions. Virtualized environments provide many benefits to the enterprise from flexibility to lower TCO but along with that have introduced a few headaches too…

- “vmotion” – servers growing legs and dynamically moving

- “vm sprawl” – servers multiplying at unmanageable rates

- Shared resources – performance, monitoring, resource accounting, etc

- Cost visibility – no longer tied to physical resources

vKernel is a new platform for system management in enterprises that are embracing virtual infrastructure to power their businesses. Enterprises IT managers face increasing challenges as virtualization spreads within the datacenter. vKernel provides an essential suite of virtual appliances tailored to meet the virtualized datacenter including chargeback and capacity planning management. These appliances require zero installation, are quick to deploy and provide insights within minutes.

More information can be found on vKernel’s website and webinars – or download the latest virtual appliance to try it out today.

Hummer Winblad’s enthusiasm in virtualization is captured by our investment in vKernel as well as several other companies including Scalent and Akimbi (acquired by VMWare).

Monday, January 28, 2008

OnMedia NYC

The conference looks like an interesting intersection of technologists, advertisers, and media companies. I will be speaking Wednesday on the OnMedia Venture Capital and Seed Financing Workshop - 10 am at the Lotus Suite.

Venture Capital and Angel Financing Workshop

Moderator: Sam Angus, Partner, Fenwick & West

Will Price, Managing Director, Hummer Winblad Venture Partners

Dan Beldy, Managing Director, Steamboat Ventures

Jed Simmons , Chief Operating Officer, co-founder, Next New Networks

Mark Stevens, Partner, Fenwick & West

While in NYC and at the conference, I would love to meet with any founders looking for their A round. Please ping me at wprice at humwin.com to set up a time to meet.

Thursday, January 24, 2008

HWVP Portfolio Job Site

The site currently lists 161 jobs. If you are looking to join a great start-up, please peruse at your leisure:)

Wednesday, January 23, 2008

Downturn - Now What?

I remember long and painful board meetings where companies decided on reductions in force, recapitalizations and investor wash outs, and the slow, painful realization that the company's infrastructure, employee base, and positioning had gotten way too far in front of economic realities.

Friends who had accepted start-up offers thinking that they would go to HP or Oracle if things did not work out suddenly found their start-ups shutting down and HP and Oracle closed to new hires. Valuations seemed absurd in retrospect, companies with no sales were sitting on $50m-100m post-money valuations, $30m of paid-in-capital, and absolutely no chance of raising money; save a complete restart. A collective "what were we thinking" rolled through the valley.

The venture industry, like the tech industry at large, slowed down to not only digest "problem" portfolio companies, but also out of fear that large enterprises were no longer buying start-up products. The industry put $100bn to work in 2001 and only ~$20bn in 2002. It is fair to say that it was a bloodbath and billions of dollars were written-off and hundreds of companies quietly shut down. Venture investors largely sat on their hands and net new deals were very few and very far between.

As we all read the economic news this month, key questions are begged....how should an economic downturn impact venture investors behavior?, are there lessons one can learn from the dot com bust that can be applied in the current housing and credit bust?, will a recession hurt our companies, perhaps fatally?

If I take the last downturn as my guide, I can say with confidence that venture investors would be well suited to continue to invest right through the downturn - in 2002 and 2003 terrific companies were formed and funded at very reasonable valuations and with business models that reflected the demand for capital efficiency and economic viability.

Like Occam's Razor, recessions whittle away unnecessary and non-value-added businesses and the capital, purchase order, and resource scarcity inherent in downturns forges companies of real substance and durability.

I do believe, however, that certain classes of company will find fund raising very challenging in this environment. The last few years saw the rise and success of "field of dreams" web companies - ie companies where the business model and economics were secondary to utility, usage, and adoption. Perhaps most famously, Twitter is exploding with the principals publicly downplaying the need to define a business model. As consumers, the innovation possible via a "field of dreams" approach is wonderful, as investors, however, the market's patience to "uncover" the economic model over time and to, in the meantime, fund continued expansion and adoption is a major risk factor.

The last downturn saw the valley swing violently away from consumers to the enterprise - bastions of value, hard ROI, tangible value propositions, enterprise pain points and budgets, etc became the mainstay of investment decisions and the consumer, I kid you not, was literally a bad word.

Partner meetings where an investor said, "I have a great deal - it is a consumer play with great adoption metrics and a plan to work out the business model over the next 18 months," were a recipe for total and outright ridicule.

The valley became all enterprise, all the time.

Now, today's companies can leverage low-cost infrastructure and an ad-market in a way that their predecessors never could. However, I believe the following will occur: new deal investing will slow, perhaps radically, the enterprise segment will regain some of its former glory, consumer companies looking for capital in the absence of working business models will find raising money next to impossible, and employees will be much more scrutinizing of the companies they elect to join.

However, history suggests that capital efficient companies solving well-characterized pain points will continue to be great investments. Valuations, input costs (labor, rent, services) will fall, and future returns will show that 2008 and 2009 were great years to do start-ups. Similarly, in early 2009, as the consumer start-up market finds itself cut off from funding, it will be pay to make bold and brave investments in the consumer space.

None of us can predict the markets or future valuations, we all, however, can understand fundamentals. Businesses that solve real pain points with disruptive technology, a huge value/price advantage, and a scalable business model will work - the kiss of death, however, will be getting the capital structure ahead of those very same fundamentals. Failure is often a function of too much capital and too high prices suddenly running into economic expectations that are materially reduced with respect to market size, market growth, and trading multiples.

To survive, one may indeed need capital. The trick is to stay lean and not to overfund and overvalue companies where the investment only "works" if it eventually trades at 8x revenue and never needs another round of funding.

It way well be that Slide raising $55m from mutual fund companies at $500m+ pre-money will be the "what were we thinking" moment of the current cycle. I think, however, the investor who leads a $4 on $4m Series A in a company with a differentiated technology and a direct tie to hard ROI will feel calm in the storm.

The Wadget Revolution - How Brands Can Harness Widgets

The title, a play on widget and gadget, will address the widget revolution and how marketers can best take advantage of this emerging channel.

I expect a lively discussion on how brands can use widgets to reach consumers and how publishers can use widgets to monetize their content.

Please find details on the panel below.

The event is at the St. Francis Hotel on Powell Street just off Union Square in downtown San Francisco. The Stockton Sutter parking garage is close by.

Abstract:

The digital channels are engaging. It's that simple. Engagement remains elusive as a singular dynamic, but seems more a catch-all descriptor/metric for a variety of mechanisms that deliver utility, information and entertainment to audiences in new ways. One of the "channels" within the broader digital mix that saw tremendous growth in '07 and really begins its sophomore year in 2008 is the "Wadget" (ok, we couldn't decide between Widget and Gadget, so we compromised). They seemed to come out of nowhere, or to be coming suddenly from everywhere and we all nodded our heads in approval (though many of us grabbed a friend and remarked "what the heck are these things anyway?". It's time to shed some light on this.

What are Wadgets, what do they do, who makes them, who uses them and most importantly, how do marketers harness the power of them are the questions we're going after at our next event on Jan 24.

We'll have some masters of Wadgetry talking about the phenomenon from their perspective and showing all of us how they concept, build, deploy, engage and SELL their Wadget genius…and then they'll take your questions, so come prepared.

The panelists are:

· Will Price – Hummer Winblad

· Donna Stokes – HP

· Heidi Henson – Rock You

· Ken Barbieri – Washington Post Newseek Interactive

· Kevin Barenblatt – Context Optional

Monday, January 21, 2008

Martin Plaehn's Quick Hits: Do's and Don'ts of Entrepreneurship

The conference brought undergraduate and graduate students from around the country interested in entrepreneurship and venture capital to SLC for a two-day event. The speakers included Bill Price (co-founder of TPG), Brad Feld, and other noted investors and entrepreneurs.

A side benefit - the Sundance Film Festival started the night we arrived and Brad and I got a chance to the see the world premier of In Bruges.

One of the panelists was Martin Plaehn, a former HWVP company CEO and current CEO of Utah-based Bungee Labs. Martin is a very sharp guy and he passed around his list of start-up do's and dont's. I thought they were terrific and include them below.

Martin Plaehn’s Quick Hits: Do’s and Don’ts of Entrepreneurship

Do’s

1. Do ensure for yourself (as founder or chief) that you are addressing a real market and a sustainable one; where the exchange of value is transacted and measured in US currency

2. Do only hire for pre-identified expertise, operating need, and the energy to accomplish excellence; if you get more, great; don’t hire otherwise

3. Do always know your cash level, weekly cash spend and receipt rates, cash-runs-out date, and close-up liabilities amounts; start finding funding choices when you hit t-minus 6 months till operating cash runs out

4. Do money deals with money people (e.g. Angels, VC’s, banks, and credit unions); do product deals with product people (eg. Commercial companies); and do risk deals with risk people (e.g. Insurance companies). Don’t get these confused. If a product company wants to invest in your company, can they afford to take the whole thing? If not, then not.

5. Do ensure that at least one of your early formal investors has the financial wherewithal to keep investing in subsequent increasing rounds many years down the road; do make sure your different investors are really compatible

6. Do always accumulate choice; two by definition, three of four is better; then make decisions and have a back-up

7. Do let the stress of overload and/or capacity strain the triggers for expansion; demand flexing the edges of the system is usually the truest sign of real growth

8. Do track revenue and cost per employee; have trigger thresholds for when to add staff or subtract. Human efficiency and innovation is what creates value

Don’ts

1. Don’t hire of goodness of heart or friendship

2. Don’t hire anyone who you and your team are not genuinely excited about

3. Don’t tolerated mediocre engineers; for that matter, mediocre anyone. An early sign of mediocrity is when you downgrade tasks and expectations to align with an employee

4. Don’t count on your investors to take care of you when things get rough and/or protracted

5. Don’t over interpret or count on the stated operating “value-add” from investors during their solicitations during fundraising

6. Don’t build out your staff or infrastructure in expectation of rapid growth; be strong enough and tolerant of market back-pressure or order/service backlog

7. Don’t keep the same sales and marketing execs if the business isn’t growing or changing for growth; no sales and marketing VP was ever fired prematurely

8. Don’t over delegate to consultants, accountants, or lawyers; even the great ones are only as good as you are as an engaged client; read and understand everything; if left alone, you must have a point of view, right or wrong

Thanks to the students at BYU, Univ of Utah, and from around the country who worked hard to make the event a real success.

Tuesday, January 15, 2008

Subprime failure and Prediction markets

Massive failure due to forecast errors.

I have written in prior posts about my respect for Nassim Taleb's book Black Swan, which speaks to the enduring inability of humans to recognize the fallibility of forecasts and linear thinking.

With respect to the subprime mess, Merrill Lynch, Morgan Stanley, and Citibank, alone, have announced $36+bn in write-downs to date. The most technically advanced companies in the country failed to live up to their raison d'etre: to price and manage risk.

Their failure is a powerful reminder that sophisticated business processes, risk management models, and management teams are no panacea if the assumptions that architect their systems are wrong.

For example, risk management is based on the premise that events in financial markets exhibit normal/Gaussian distributions. Value-at-risk models calculate the maximum loss not exceeded with a given probability/confidence interval over a given period of time. For example, the risk manager will report that with a 95% confidence the maximum capital at risk is $x. The losses in the financial sector are a powerful reminder of how rare events blow up the models and with them the business processes, risk controls, and balance sheets of their creators.

In supply chains, forecast errors compound across the supply chain in a phenomena known as the bullwhip effect resulting in excess inventory and a costly failure to match supply with demand.

Examples of forecast errors are legion - product ship dates, sales forecasts, demand forecasts, value-at-risk models, elections, stock price predictions, etc. A common remedy to forecast errors is to increase the liquidity of guesses - the greater the number of independent predictions the more accurate, in aggregate, the final prediction.

We can see this phenomena in today's social web - the web is rewriting the rule book on how we program content- rather than a top-down, command economy approach, where programmers decide what we should read, watch, and discuss - users are leverage social media sites to "reprogram" content. Communities, like liquid markets, vote with their time, comments, and clicks and the best of the web gets pushed to the top. Innovative companies are leveraging the wisdom of the community to ensure a better match between supply and demand.

So, where am I going with this post? Prediction markets are nascent business tools that allow employees to buy or sell certain business events - probability of product shipping on time, unit volumes to ship in the quarter, annual bookings, prioritizing new business ideas - and thereby allow their employers to improve the quality of information factored into predictions. The formal chain of command is infamous for distorting and hiding information - it is no wonder that CEOs are flying blind...their business systems are based on flawed models and their teams are incapable of accurately reporting the true state of affairs. Chinese whispers corrupts information moving up the chain and smart people are stuck making decisions with bad, misleading data.

We will never be able to predict the future, however, all of us should consider how we can open up our decision making processes to allow for non-biased, comprehensive input that allows the wisdom of our organizations to weigh in on key decisions - better inputs enable better capital and resource allocation decisions and can help avoid disaster.

While prediction markets are much less complex than advanced prediction algorithms, in the spirit of less is more, the front line sales people, developers, mortgage loan officers, etc will always have better information than the central corporate staff. What seems to be failing corporate America is an open framework for capturing that knowledge in a non-biased, confidential manner.

For centuries soldiers have complained that the central staff had no idea what was happening on the ground - the science, tools, and applications, however, exist today that allows for the harvesting of the collective wisdom of the group.

I predict, yes am I aware of the irony, that in 2008 corporate American will come to adopt one of the mainstays of web 2.0 - ie applications that leverage the tacit or explicit wisdom of a community. Prediction markets are needed to help unlock the tacit knowledge of organizations and to lessen the colossal forecast errors now reverberating through our economy.

Content Community on Innovation, Start-ups, and Venture Capital

The site is dedicated to sharing ideas, books, best practices, news, etc on entrepreneurship, venture capital, and new company formation.

To join Corank, click here. To add the RSS feed, click here. To add a Firefox bookmarklet to post articles to the community, click here.

I hope that this site fosters the sharing of ideas that will help all of us. Please do join and share content that matters to you.

A widget of the current top content stories follows:

Thursday, January 03, 2008

New Deal Checklist

I put together an analog to the pre-flight checklist - a new deal checklist - that I hope will similarly help avoid losses due to "pilot error."

In the spirit of transparency, please see my list below and let me know if you think I am missing any core issues.

- Can I understand the business?

- what is the product?

- what is the value?

- who is the buyer and why would they buy?

- can the buyer quantify the value? If so, what unit?

- Is the market attractive?

- Growth rates?

- Profitability?

- Is there a fundamental disruption that is the basis for the opportunity and limits the incubments' competitive repsonse?

- Market --> SaaS, Open Source

- Product --> core innovation

- Is the product delivered in a buyer appropriate way?

- open source for infrastructure

- SaaS for a business app buyer

- REST/SOAP/JavaScript for a web service

- Is the core value tied to a technical innovation?

- ex. HWVP's portfolio company examples = Baynote's collective intelligence algorithms and Move Networks' streaming protocols

- Are their frictions in....?

- time and resources required to test the value proposition?

- time and resources required to deploy?

- time and risk to realize value?

- Is there a good market comparable for both the business model and the exit multiple?

- What unit scales the revenue model?

- page views, sales heads, downloads, sessions?

- Is the architecture scalable and does it leverage the best available infrastructure - EC2, S3, Rackspace, etc?

- Are there exogenous dependencies?

- carrier or MSO deals?

- RFID deployments, etc?

- Is there a market master?

- WMT or MSFT or Dell....

- Who is the incumbent? How will they react?

- Who are the other new companies in the space?

- Is the team able and honest?

- Prior track record of working together?

- Is the CEO special?

- What is his/her motivation, passion, strength?

- Where do they need help and complement?

- Are the round size and pre-money reasonable?

- Is the model reasonable (profit margins, growth, burn)?

- Is the plan capital efficient?

- how much money for 18 months?

- margin of safety?

- are their clear milestones in the plan that will allow for an objective assessment of value creation - ie a new investor

- Can this be a homerun?

- What are the core risks?

- why will the company fail? is their a plan in place to mitigate such risks?

- What are the KPIs - ie leading indicators to measure and track the company's progress?

- Is the cap table clean and the paid-in capital reasonable?

- Is the progress to date commensurate with the money in?

- Has the money in to date been productive?