Today, the

NVCA announced Magnet USA, a program designed to strengthen America's competitive position in the global economy. I am all for programs designed to stimulate and encourage innovation. Innovation creates jobs, wealth, and increased social utility. However, America's long term security and capacity to support innovation is under tremendous pressure.

Bill Gross' recent column compares the future fate of America to the current state of GM. Gross attributes GM's malaise to uncompetitive labor costs and the burden of pension and health care liabilities. He argues that we are glimpsing America's future in the GM's current struggle to remain solvent, reduce its fixed costs, and reduce future pension and healthcare obligations via employee buyouts. It is a worthwhile and scary read.

Is this overly negative thinking? I went to Whitehouse.gov and read through the

OMB's assessment of America's future to find out. Unhappily, I found the following:

"While the near-term outlook for shrinking deficits is encouraging, the long-term picture presents a major challenge due to the expected growth in spending for major entitlement programs. In only two years, the leading edge of the baby boom generation will become eligible for early retirement under Social Security. In five years, these retirees will be eligible for Medicare. The budgetary effects of these milestones will be muted at first. But if we do not take action soon to reform both Social Security and Medicare, the coming demographic bulge will drive Federal spending to unprecedented levels and threaten the NationÂ’s future prosperity.

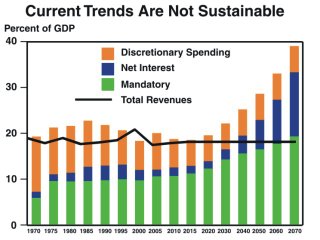

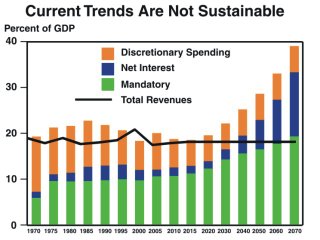

No plausible amount of cuts to discretionary programs or tax increases can help us avert this major fiscal challenge. As the accompanying chart shows, assuming mandatory spending continues on its current trajectory and the tax burden is held at historical levels, by 2040 Federal spending will accelerate to a level at which mandatory outlays and debt service would consume all Federal revenue. By 2070, if we do not reform entitlement programs to slow their growth, the rate of taxation on the overall economy would need to be more than doubled, placing a crushing burden on the economy that is required to produce the revenues to support the Government programs in the first place."

Wow. According to the OMB, by 2040 all our tax revenue will go to entitlement spending and debt service. How we will invest in the future - research, education, infrastructure - if we are seeing an ever smaller amount of US government revenues available for discretionary spending?

The technology market feels good right now - new companies, models, and innovation is strong. What frightens me is when the OMB and major bond holders forecast a financial meltdown and the eventual devaluation of the US currency, rising interest rates, and a social contract (entitlement spending) that will literally break the bank.

As the VC industry discusses globalization and the merits of offshore investing, a key part of the conversation may be the fundamental, long term macro trends that are shaping the face of future opportunity and innovation. Certainly, the OMB paints a bearish view of America and a compelling reason to start thinking about offshore investing and non-US dollar holdings.

I recently heard someone argue that capital is a coward - it seeks refuge in safe-havens. Unless, we in America are able to make difficult decisions and reduce the fixed costs in the governmemt budget, as GM is laboring to do today, capital will eventually flow out the US and to more attractive safe harbors. Hopefully, unlike energy policy/problems, these entitlement burdens will become part of the political discourse while we still have time to make painful choices to avert painful outcomes.